BUSINESS

How Investment Banks Propel Company Growth

Understanding Investment Banking Roles

Investment banks are crucial facilitators in the financial landscape, offering many services designed to help businesses secure their financial footing and achieve significant growth. Their roles encompass much more than just providing financial advice; they deliver various solutions that can transform a company’s financial health and prospects. With a comprehensive understanding of economic factors and trends, an investment bank helps organizations navigate the complexities of financial markets. Companies seeking to expand often leverage the expertise of investment banks to craft strategies that align with their growth ambitions while minimizing financial risks.

Advisory Services for Mergers and Acquisitions

One of the main components of investment banking services is advisory services for mergers and acquisitions (M&A). The guidance in this domain is essential for companies looking to scale by merging with or acquiring other businesses. An investment bank’s role includes:

- Conducting rigorous due diligence.

- Assessing the financial health of potential partners.

- Negotiating terms that benefit their clients.

By leveraging extensive industry knowledge and analytical tools, investment banks help firms navigate the complexities of M&A transactions. This support ensures that the legal and financial aspects are in check, allowing companies to concentrate on post-merger integration and growth. More details on the driving forces behind M&A can be found in this Forbes article.

Capital Raising and Financing Options

Raising capital is fundamental to any business with aspirations for growth, and investment banks play an integral role in this process. Businesses use the experience of these institutions to obtain a range of financial products, including debt and equity options. An investment bank evaluates a company’s financial needs and recommends suitable avenues to secure the necessary funds. This might involve issuing new stocks or bonds or utilizing hybrid financial products that offer flexible financing options. Through their global networks and market insights, investment banks can connect companies with potential investors, facilitating transactions that might otherwise be out of reach. This is especially important for startups and companies entering new markets, where rapid access to cash can significantly impact their growth trajectory.

Market Insights and Strategies

Understanding market dynamics is more important than ever in today’s fast-paced and interconnected global economy. Investment banks provide invaluable market insights that help businesses make informed decisions. They give businesses the knowledge they need to take advantage of new possibilities while reducing risks by analyzing data, researching market trends, and projecting economic changes. Whether identifying potential markets for expansion or recognizing threats that could impact performance, the strategic insights investment banks offer can drive a firm’s success. With a finger on the pulse of worldwide financial markets, these banks tailor strategies that align with a company’s unique objectives, fostering sustainable growth. For a deeper dive into how these banks interpret market trends, you can explore this article on CNBC.

Risk Management Services

Risk management is critical to any growth strategy, and investment banks provide sophisticated solutions to address this need. These banks identify potential risks businesses might face through comprehensive assessments in varying market conditions. From political instability and currency fluctuations to industry-specific challenges, investment banks tailor risk management strategies that suit each client’s circumstances. Banks empower businesses to protect their investments and ensure long-term viability by developing tools and frameworks for managing these risks. Moreover, anticipating and mitigating risks enables companies to focus on innovation and expansion rather than being mired in unforeseen financial setbacks.

Facilitating Initial Public Offerings (IPOs)

For many companies, launching an initial public offering (IPO) represents a transformative stage in their growth journey. Investment banks are pivotal in this process, helping firms prepare for a successful public debut. They guide businesses through the complex regulatory landscape, ensure compliance with stringent governmental requirements, and manage the logistics of the offering. Moreover, investment banks help determine the optimal pricing of shares, balancing market demand with company valuation. Handling these intricate details allows businesses to focus on their operations and growth strategies post-IPO while ensuring a seamless transition to public company status. The support provided during IPOs sets the stage for companies to secure substantial funding from the broader public markets, providing ample resources for expansion and innovation.

Global Networking and Opportunities

In a world where globalization dictates market trends, tapping into cross-border opportunities is imperative for sustained growth. Investment banks offer their clients access to a vast international network of investors, partners, and markets. These networks provide companies unique opportunities to explore and enter new markets, diversify revenue streams, and establish strategic partnerships. Whether a firm is looking to expand its supply chain, invest in foreign infrastructure, or take advantage of favorable market conditions abroad, the global reach of investment banks proves invaluable. By leveraging these networks, businesses gain insights into local consumer behavior, regulatory environments, and competitor strategies, which are crucial to crafting effective international growth strategies.

Conclusion: Empowering Business Growth

Investment banks are more than just financial advisors; they are pivotal partners in a company’s growth journey. With services ranging from M&A advisory and capital raising to risk management and market insights, they lay the groundwork for businesses to scale new heights. By fostering well-grounded strategies and providing access to critical resources and networks, investment banks empower companies to navigate the challenges of modern finance and seize opportunities for innovation and expansion. The collaboration between firms and investment banks ultimately sets the stage for sustainable development and long-term success in an ever-evolving economic landscape.

BUSINESS

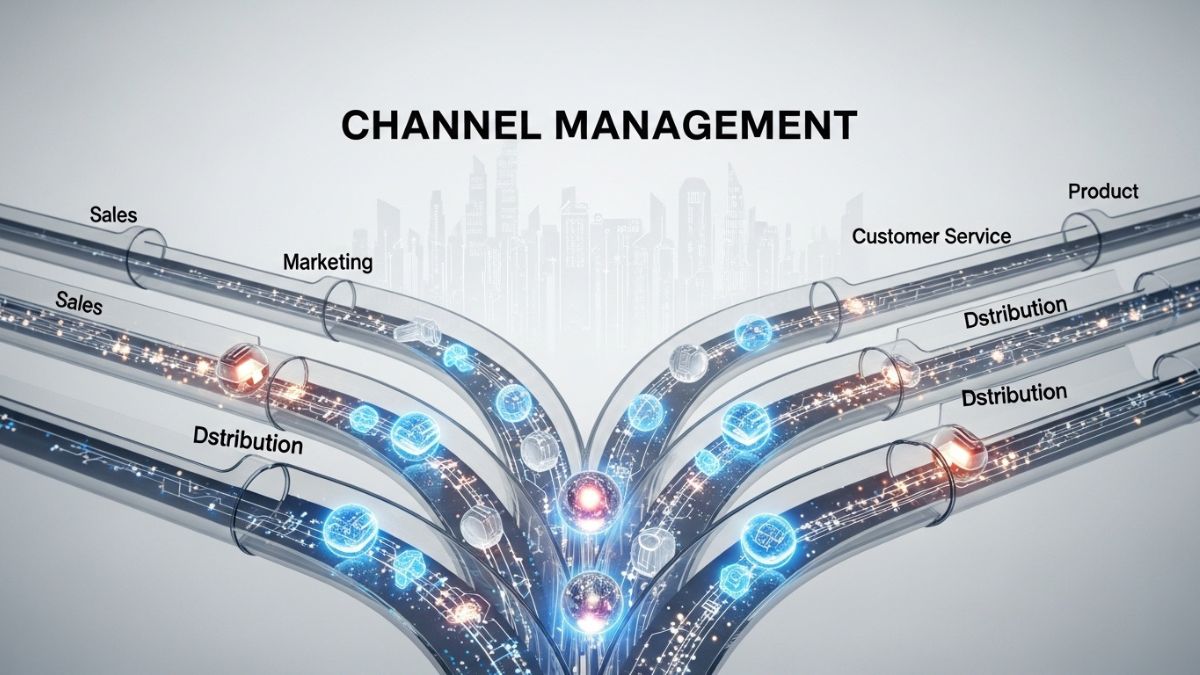

channel management: plays a critical role in how businesses

BUSINESS

Behind the Scenes: Unpacking the Walmart Truck Driver Lawsuit

The wheels of justice are turning, and they’re Walmart Truck Driver Lawsuit rolling straight towards one of the biggest names in retail: Walmart. The ongoing lawsuit involving Walmart truck drivers has captured attention across the nation, shedding light on crucial issues within the trucking industry. As allegations surface and advocacy groups rally for change, this case is more than just a legal battle; it’s a pivotal moment that could reshape how we view labor rights in transportation. Join us as we unpack the details behind this high-stakes controversy and explore what it means for truck drivers everywhere.

Background and Overview of the Lawsuit

The Walmart Truck Driver Lawsuit emerged as a significant legal battle in the trucking industry. It centers on claims made by drivers regarding working conditions, pay, and safety protocols.

Drivers allege that Walmart imposes unrealistic expectations. These demands can lead to unsafe driving practices and increased stress levels among employees. Many have expressed concerns about long hours without adequate breaks.

The lawsuit also highlights discrepancies in compensation. Drivers argue they are not fairly compensated for all their time spent on duty. This includes wait times at loading docks and other delays beyond their control.

As this case progresses through the courts, it represents more than just one company’s practices; it shines a light on broader issues within the logistics sector that affect countless professionals nationwide.

The Allegations Against Walmart

The Walmart Truck Driver Lawsuit centers on serious allegations regarding labor practices. Plaintiffs claim that the retail giant has failed to provide safe working conditions for its truck drivers.

Reports suggest that drivers are pressured to meet unrealistic delivery deadlines. Such demands can lead to fatigue and increase the risk of accidents on the road.

Additionally, there are accusations concerning inadequate training for new hires. This could leave inexperienced drivers vulnerable in a demanding environment.

Furthermore, some former employees highlight issues related to wage disputes. They argue that overtime hours often go uncompensated, raising significant concerns about fair pay within the organization.

These allegations paint a troubling picture of Walmart’s treatment of its driving workforce, sparking intense discussions within both legal and advocacy circles.

Impact on Truck Drivers

The Walmart Truck Driver Lawsuit has sparked significant concern among truck drivers nationwide. Many are now questioning their own job security and working conditions.

Drivers rely heavily on the trucking industry for stable employment. This lawsuit brings to light issues that resonate with countless professionals behind the wheel. It highlights long-standing grievances about pay, hours, and safety regulations.

Increased scrutiny from legal actions like this could lead to stricter regulations across the board. Drivers might find themselves in more favorable positions regarding labor rights if changes do occur.

However, there’s also fear of potential backlash from companies aiming to protect profits. Some worry that tighter regulations could result in fewer jobs or reduced hours as businesses adjust.

This lawsuit places a spotlight on an industry already facing numerous challenges. The outcome may shape not just Walmart but also the future landscape of trucking for many drivers.

Reactions from Advocacy Groups and Legal Experts

Advocacy groups have been vocal in their support for the truck drivers involved in the lawsuit against Walmart. They argue that these employees deserve fair treatment and safe working conditions. Many believe this case could set a significant precedent for labor rights within the trucking industry.

Legal experts express mixed opinions on the potential outcome. Some see merit in the allegations, pointing to past cases where corporations were held accountable for similar issues. Others caution that Walmart’s legal team is formidable and experienced at navigating such challenges.

Industry analysts worry about broader implications if Walmart loses. Increased regulations may follow, impacting not only large retailers but also smaller trucking companies struggling to keep up with compliance costs. The conversation surrounding worker rights continues to gain momentum as more voices join this pivotal discussion.

Potential Ramifications for Walmart and the Trucking Industry

The Walmart Truck Driver Lawsuit could have far-reaching consequences for the retail giant and the trucking industry as a whole. If the allegations are proven true, Walmart may face significant financial penalties and reputational damage. This could lead to shifts in their operational practices.

For the trucking sector, this case highlights ongoing concerns about driver treatment and working conditions. Other companies might reconsider their own policies regarding labor rights to avoid similar lawsuits.

Additionally, if regulatory bodies take notice of this lawsuit, we may see stricter regulations imposed on trucking firms nationwide. This would increase compliance costs and potentially reshape how drivers are hired and managed.

As public sentiment grows against large corporations that allegedly exploit workers, consumer behavior might shift too. Shoppers increasingly support brands with ethical labor practices; thus, Walmart’s response will be closely scrutinized moving forward.

Conclusion: What This Lawsuit Means for the Future of Trucking Regulation

The Walmart Truck Driver Lawsuit has the potential to reshape how trucking regulations are viewed and enforced across the industry. As allegations of unfair treatment and unsafe working conditions come to light, it raises significant questions about corporate responsibility.

If the lawsuit leads to changes in policies or practices at Walmart, it may set a precedent that other companies might follow. This could lead to broader reforms aimed at protecting truck drivers from exploitation and ensuring safer work environments.

Advocacy groups are closely monitoring this case, hoping for outcomes that prioritize driver welfare over profit margins. Legal experts suggest that if successful, this lawsuit could inspire similar claims against other major players in the trucking sector.

The ripple effects of this legal battle extend beyond just Walmart; they touch upon issues like labor rights, safety standards, and regulatory oversight within an essential industry. As more stakeholders engage with these topics, we may see a shift toward greater accountability for corporations operating within logistics.

The outcome of this lawsuit will not only impact Walmart but also influence trucking regulation as a whole. It serves as a critical juncture for advocates pushing for change in an industry often overlooked despite its vital role in our economy.

BUSINESS

Unlock Your Potential: The Newcomer’s Handbook to Becoming a Notary Public

Why Notaries Matter

Notaries public are essential guardians of trust in legal, financial, and business transactions. Their primary roles are to verify identities, witness signatures, and administer oaths, making them crucial in preventing fraud and protecting private citizens and organizations. Notaries add objectivity and verification to contracts, property deeds, powers of attorney, and more. With over 4 million active notaries in the U.S., as reported by the National Notary Association, they impact nearly every industry. Whether considering becoming a new notary Arizona or learning about the field, recognize how often notaries’ signatures are relied upon for legal assurance.

Behind every real estate purchase, business agreement, living will, or loan document, a notary is acting as an impartial witness. This official supervision enhances public trust and reduces the potential for future disputes and legal problems. In numerous states, document notarization is mandatory, emphasizing the notary’s importance within the larger legal and commercial framework.

Basic Steps To Becoming A Notary Public

The process of becoming a notary public involves meeting specific state requirements, such as being at least 18 years old, a resident or employee of the state, and being free from significant criminal convictions. To become a notary, applicants must complete a notary application and pay a processing fee. Eligibility checks may include proof of residency, U.S. citizenship, or permanent residency, as well as the ability to read and write the English language. The application may involve completing online forms, using payment portals, or visiting a local office in person. If required, training is necessary to understand the duties of the role. A background check and exam are also required to ensure the role’s integrity. Notary bonds are needed to protect the public from errors or misconduct, and applicants must purchase necessary supplies. The process typically takes weeks, but timeframes may be extended if training slots or background checks require additional time. State offices and professional notary associations provide checklists and helpline support to guide applicants through the process efficiently.

Education And Training Tips

Notary education is crucial for trustworthy service, with about half of the states mandating or recommending formal instruction. Well-trained notaries make fewer mistakes, leading to greater confidence and fewer legal challenges for clients and employers. Training programs cover various aspects, including proper identification checks, utilizing credible witnesses, managing unusual requests, and maintaining secure records. Attending in-person classes, webinars, or interactive modules can help prepare for both routine appointments and complex circumstances. Notaries can analyze example documents, practice scripts for administering oaths, simulate notarial acts with hypothetical clients, and join study groups or notary forums to discuss questions and evolving laws. Continuing education is a helpful habit, with active notaries often attending refresher courses or legal update seminars.

Navigating Background Checks And Ethics

Trust and transparency are crucial for effective notarial practice. A thorough background check is required for aspiring notaries, as they have the power to witness high-stakes exchanges. Disqualifications for convictions involving dishonesty, fraud, or violent offenses usually result in disqualification. True professionalism demands strict adherence to ethical standards, avoiding conflicts of interest, and refraining from actions that compromise impartiality. Detailed journals, transparency with signers, and thorough identity vetting reinforce trust. Every notarial act must be recorded carefully, and refusing service is the correct decision if conditions aren’t legally or ethically sound. Notaries are at the forefront of safeguarding public interests in the digital age.

Preparing For The Notary Exam

Notary exams in mandatory states require thorough preparation. Exams typically consist of multiple-choice or scenario-based questions, assessing the understanding of the law and the ability to apply judgment in real-life situations. To pass, read your state’s official notary handbook, memorize core duties, practice with quiz apps, online flashcards, or sample tests, study irregular scenarios, and review common reasons for failure. Time management is crucial, with study sessions scheduled in advance, breaking material into bite-sized topics, and seeking help from mentors or online communities. Passing on the first try is common for test-takers who dedicate steady effort.

Setting Up Your Notary Business

After being commissioned, it’s crucial to plan how to operate a notary service, whether it’s a part-time side gig, a full-time mobile business, or an in-office service. Consider your goals, logistical preferences, service area, and target clientele. Order quality notary seals and supplies, set up a secure location for your journal, confidential documents, and digital records, research mobile notary opportunities, and create business cards for clients. Network with local professionals and establish policies for scheduling, cancellations, and fees. Notary professionals who go above and beyond with courteous service are often rewarded with repeat business and word-of-mouth referrals. Flexibility, such as offering evening and weekend appointments, can lead to success in high-demand communities.

Keeping Up With Legal Changes

Notarial law is rapidly evolving, with remote and electronic notarization becoming more prevalent. Notaries must regularly update their knowledge base to stay informed about identification requirements, fees, and technological changes. Subscribing to bulletins and attending seminars can help you stay updated on industry trends and legal changes. Being proactive not only ensures compliance but also allows notaries to offer innovative solutions to clients.

-

BLOG1 year ago

BLOG1 year agoEscape to Tranquility Experience Grange Bardage Percheronne in Normandy

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoAir Jordan 1 Retro High Off-White University Blue

-

SOCIAL MEDIA1 year ago

SOCIAL MEDIA1 year agoDecoding the Drive Social Media Pyramid Scheme Mystery

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoAir Jordan 4 Retro Metallic Purple

-

BLOG9 months ago

BLOG9 months agoDecoding 540-315-8592: From Numbers to Messages

-

HOW-TO GUIDES1 year ago

HOW-TO GUIDES1 year agoShop Smart and Save with Goldengatemax.shop Online Guide

-

BUSINESS1 year ago

BUSINESS1 year agoDemystifying 315-442-5267 Common Myths and Facts Revealed

-

LIFESTYLE1 year ago

LIFESTYLE1 year agoAir Force 1 Shadow Pistachio Frost