BUSINESS

The Intricacies of LTL Freight Shipping: A Comprehensive Guide

Introduction to LTL Freight

Less-than-truckload (LTL) freight shipping has revolutionized the logistics industry by offering a flexible and cost-saving solution for businesses needing smaller shipments. LTL freight enables several shippers to share space on a single vehicle, unlike full truckload (FTL) shipping, which requires a whole truck for a single cargo. This collaborative approach reduces transportation costs, optimizes resource use, and minimizes environmental impact. Companies can streamline their logistics operations by opting for LTL freight, ensuring timely deliveries, and maintaining customer satisfaction without the financial burden of a full truckload.

The LTL Shipping Process

Less-than-truckload shipping is intricate and efficient, consisting of several critical stages to ensure that goods are delivered promptly and in good condition. It begins at the local terminal, where shipments from various shippers are carefully consolidated, labeled, and palletized. This initial stage maximizes space usage and safeguards cargo against damage. As the consignment progresses, it may stop at multiple hubs for sorting and rerouting. Each hub uses advanced tracking technology to monitor the shipment’s journey, informing shippers of its status at every step. Understanding this process helps businesses better appreciate the logistical coordination in moving freight across regions.

Benefits of LTL Freight

- Cost Efficiency: One of the most notable advantages of LTL freight is its cost-effectiveness. Shippers pay only for the portion of the truck their goods occupy, making it an attractive option for smaller shipments or businesses with fluctuating delivery needs. The shared-cost model translates into significant savings compared to booking an entire truck for underutilized space.

- Eco-Friendly: By consolidating shipments, LTL freight reduces the number of trucks on the road, decreasing fuel consumption and lowering carbon emissions. This environmentally friendly logistics strategy helps businesses contribute to sustainable practices and meet corporate social responsibility targets.

- Flexibility: LTL freight allows businesses to ship goods that do not require a full truckload, accommodating varied sizes and weights. This flexibility benefits e-commerce firms and startups with diverse products and unpredictable shipping patterns.

Choosing a Reliable Provider

Locating a trustworthy LTL freight service is essential to guarantee a seamless and practical shipping experience. Businesses should prefer companies with a history of reliably and regularly handling shipments. Assessing a provider’s customer service quality and transparency in pricing are also necessary factors. Companies investing in advanced tracking and communication technology often stand out as more reliable partners. Competent providers will transport goods safely and offer support and solutions in case of unexpected delays or issues. For more insights on choosing the right provider, consulting articles on industry standards can be beneficial.

Common Challenges

Like any shipping method, LTL freight comes with its set of challenges. The consolidation process at multiple hubs means shipments may experience delays—particularly during peak shipping seasons. There is also a risk of cargo damage due to additional handling by different parties. Businesses must weigh these potential setbacks against LTL’s economic and operational benefits. By understanding these challenges, companies can prepare contingency plans to ensure their shipping operations remain efficient and reliable.

Tips for Successful Shipping

- Plan Ahead: Planning is essential to account for potential delays, particularly during peak times or adverse weather conditions. Early booking often results in better scheduling options and cost savings.

- Pack Properly: Proper packaging is vital to prevent damage during transit. Using durable materials and clear labeling helps protect goods and ensure they reach their destination intact.

- Communicate Clearly: Effective communication about your needs with your LTL supplier can streamline the shipping process and avoid misunderstandings. Accurate information regarding your shipment’s size, weight, and handling requirements ensures better service and fewer disruptions.

Future Trends in LTL Shipping

Rapid technology improvements and growing demand for sustainable logistics drive significant change in the less-than-truckload (LTL) transportation industry. Digital platforms have emerged as crucial tools in this evolution, providing features such as real-time tracking capabilities, which enable clients and shippers to track the whereabouts and status of their goods at any time. These platforms also utilize predictive analytics to forecast potential delays and optimize shipping routes, ultimately enhancing overall efficiency.

In addition to improved tracking and analytics, automation is pivotal in redefining LTL shipping operations. From automated scheduling to streamlined documentation processes, these innovations reduce operational costs and minimize human error while accelerating the shipment lifecycle.

As the industry embraces these technologies, there is also a growing commitment to sustainable practices. Many companies prioritize environmental responsibility, leading to a notable shift towards green logistics strategies. It includes adopting electric and hybrid vehicles, reducing carbon emissions, and lowering fuel costs in the long run. Furthermore, logistics firms are optimizing their routes to minimize fuel consumption and emissions, emphasizing a commitment to sustainability without compromising efficiency.

For organizations hoping to succeed in this ever-changing environment, keeping up with the most recent developments in logistics is essential. By leveraging these technological advancements and adopting sustainable practices, companies can improve their operational performance and increase client happiness, gaining a competitive advantage in the marketplace.

BUSINESS

Unlock Your Potential: The Newcomer’s Handbook to Becoming a Notary Public

Why Notaries Matter

Notaries public are essential guardians of trust in legal, financial, and business transactions. Their primary roles are to verify identities, witness signatures, and administer oaths, making them crucial in preventing fraud and protecting private citizens and organizations. Notaries add objectivity and verification to contracts, property deeds, powers of attorney, and more. With over 4 million active notaries in the U.S., as reported by the National Notary Association, they impact nearly every industry. Whether considering becoming a new notary Arizona or learning about the field, recognize how often notaries’ signatures are relied upon for legal assurance.

Behind every real estate purchase, business agreement, living will, or loan document, a notary is acting as an impartial witness. This official supervision enhances public trust and reduces the potential for future disputes and legal problems. In numerous states, document notarization is mandatory, emphasizing the notary’s importance within the larger legal and commercial framework.

Basic Steps To Becoming A Notary Public

The process of becoming a notary public involves meeting specific state requirements, such as being at least 18 years old, a resident or employee of the state, and being free from significant criminal convictions. To become a notary, applicants must complete a notary application and pay a processing fee. Eligibility checks may include proof of residency, U.S. citizenship, or permanent residency, as well as the ability to read and write the English language. The application may involve completing online forms, using payment portals, or visiting a local office in person. If required, training is necessary to understand the duties of the role. A background check and exam are also required to ensure the role’s integrity. Notary bonds are needed to protect the public from errors or misconduct, and applicants must purchase necessary supplies. The process typically takes weeks, but timeframes may be extended if training slots or background checks require additional time. State offices and professional notary associations provide checklists and helpline support to guide applicants through the process efficiently.

Education And Training Tips

Notary education is crucial for trustworthy service, with about half of the states mandating or recommending formal instruction. Well-trained notaries make fewer mistakes, leading to greater confidence and fewer legal challenges for clients and employers. Training programs cover various aspects, including proper identification checks, utilizing credible witnesses, managing unusual requests, and maintaining secure records. Attending in-person classes, webinars, or interactive modules can help prepare for both routine appointments and complex circumstances. Notaries can analyze example documents, practice scripts for administering oaths, simulate notarial acts with hypothetical clients, and join study groups or notary forums to discuss questions and evolving laws. Continuing education is a helpful habit, with active notaries often attending refresher courses or legal update seminars.

Navigating Background Checks And Ethics

Trust and transparency are crucial for effective notarial practice. A thorough background check is required for aspiring notaries, as they have the power to witness high-stakes exchanges. Disqualifications for convictions involving dishonesty, fraud, or violent offenses usually result in disqualification. True professionalism demands strict adherence to ethical standards, avoiding conflicts of interest, and refraining from actions that compromise impartiality. Detailed journals, transparency with signers, and thorough identity vetting reinforce trust. Every notarial act must be recorded carefully, and refusing service is the correct decision if conditions aren’t legally or ethically sound. Notaries are at the forefront of safeguarding public interests in the digital age.

Preparing For The Notary Exam

Notary exams in mandatory states require thorough preparation. Exams typically consist of multiple-choice or scenario-based questions, assessing the understanding of the law and the ability to apply judgment in real-life situations. To pass, read your state’s official notary handbook, memorize core duties, practice with quiz apps, online flashcards, or sample tests, study irregular scenarios, and review common reasons for failure. Time management is crucial, with study sessions scheduled in advance, breaking material into bite-sized topics, and seeking help from mentors or online communities. Passing on the first try is common for test-takers who dedicate steady effort.

Setting Up Your Notary Business

After being commissioned, it’s crucial to plan how to operate a notary service, whether it’s a part-time side gig, a full-time mobile business, or an in-office service. Consider your goals, logistical preferences, service area, and target clientele. Order quality notary seals and supplies, set up a secure location for your journal, confidential documents, and digital records, research mobile notary opportunities, and create business cards for clients. Network with local professionals and establish policies for scheduling, cancellations, and fees. Notary professionals who go above and beyond with courteous service are often rewarded with repeat business and word-of-mouth referrals. Flexibility, such as offering evening and weekend appointments, can lead to success in high-demand communities.

Keeping Up With Legal Changes

Notarial law is rapidly evolving, with remote and electronic notarization becoming more prevalent. Notaries must regularly update their knowledge base to stay informed about identification requirements, fees, and technological changes. Subscribing to bulletins and attending seminars can help you stay updated on industry trends and legal changes. Being proactive not only ensures compliance but also allows notaries to offer innovative solutions to clients.

BUSINESS

Unveiling PMATGA CSFD: Deciphering Its Digital Impact and Origins

The digital world is constantly evolving, introducing us to new terms, tools, and technologies. Among those, PMATGA CSFD has recently captured the curiosity of professionals and enterprises alike. But what exactly is PMATGA CSFD? Where did it come from, and why does it matter in today’s digital landscape?

This article will break down the origins, meaning, and applications of PMATGA CSFD while exploring its profound impact in the digital and technological realms. By the end of this post, you’ll have the insights needed to understand its relevance and significance for your industry or area of expertise.

What is PMATGA CSFD?

PMATGA CSFD is a complex acronym with ties to data-driven analysis, communication protocols, and systems modeling. While its bulky name might be intimidating, its underlying concepts are designed to simplify processes, improve efficiency, and reshape digital ecosystems.

Deconstructing the Acronym

Unlike familiar terms such as AI or blockchain, PMATGA CSFD requires a closer look at its individual components to understand its value. Here’s a structural breakdown of what it represents:

- PMATGA focuses on Performance Metrics and Algorithm Tracking, guiding adaptive systems to enhance data processing.

- CSFD stands for Centralized System Flow Design, which revolves around seamless coordination in distributed systems.

Together, PMATGA CSFD symbolizes a convergence of technology, communication, and operational alignment.

The Origins of PMATGA CSFD

PMATGA CSFD is not just a recent buzzword but the result of a decade-long evolution in response to technological demands like efficiency and scalability. It originates from innovations in fields like artificial intelligence, big data, and system engineering.

A Shift Toward Centralization

Over the years, businesses have increasingly relied on centralizing their digital infrastructure. PMATGA CSFD plays a role in this by creating standardized flow systemic designs to streamline the fragmented nature of existing processes.

For example, think of how cloud storage systems, such as AWS or Google Cloud, have evolved to centralize data processing and storage solutions. Similarly, PMATGA CSFD accelerates the coherence necessary in backend operations that generate large-scale traffic.

The Role of Adaptive Algorithms

The “PMATGA” component of this technology links closely to adaptive algorithms, capable of learning from performance metrics and optimizing actions in real time. These algorithms serve as the critical brainpower behind the digital systems PMATGA CSFD impacts.

PMATGA CSFD’s Digital Impact

Enhancing Data Flow and Precision

One of PMATGA CSFD’s most celebrated characteristics is its ability to organize chaotic digital data flows. With increasing amounts of unstructured data in use, traditional systems alone cannot handle the organizational overload. Here’s where PMATGA CSFD jumps in, acting as an orchestrator of data precision.

For instance, startups utilizing PMATGA CSFD have reported improvements of up to 25% in operational response times, resulting in cost-efficient workflows.

Revolutionizing Communication Protocols

PMATGA CSFD also introduces groundbreaking changes to communication protocols between systems, improving speed and reducing latency. Whether it’s ensuring uninterrupted streaming or enabling lightning-fast e-commerce transactions during high-demand seasons, it powers the smooth flow of digital interactions.

Boosting Efficiency in Digital Infrastructure

By providing centralized infrastructure combined with adaptive decision-making, PMATGA CSFD’s lowers inefficiencies in redundant digital processes. It serves businesses as a means to reduce operational redundancies and meet scaling demands without compromising on quality.

Transforming Artificial Intelligence Applications

PMATGA CSFD’s also reinforces AI-dependent technologies, particularly in areas like predictive analysis, automated workflows, and smart IoT solutions. It refines underlying systems to boost performance and ensures appropriate allocation of resources for high-traffic platforms or critical operational tasks.

How is PMATGA CSFD Shaping Industries?

At its core, PMATGA CSFD’s adapts to meet the specific demands of different industries. Here’s how it’s actively reshaping sectors in the digital age.

E-commerce and Retail

With its focus on centralized systems and real-time algorithm adjustments, PMATGA CSFD’s optimizes customer workflows in e-commerce. Personalized recommendations, streamlined checkout processes, and inventory optimizations are all improved under its design principles.

Finance and Fintech

Financial institutions benefit from PMATGA CSFD’s ability to handle high-value transactions securely and without delay. It supports real-time fraud detection systems, analyzes market trends more efficiently through adaptive analysis, and strengthens compliance frameworks.

Health Tech

The healthcare industry is famously bogged down by data silos, delayed communications, and inefficient workflows. By introducing centralized designs and smarter adaptations using PMATGA CSFD’s , health tech solutions can improve patient record management, predictive diagnosis, and resource distribution.

Entertainment Streaming Services

Sectors like on-demand entertainment rely heavily on flawless system performance. PMATGA CSFD’s aligns server outputs with user demand, ensuring uninterrupted viewing experiences even during high surge hours.

Why PMATGA CSFD May Be Essential for Your Business

Still wondering if PMATGA CSFD’s applies to your work or enterprise? Here are the key reasons why considering it as part of your tech stack innovation may be in your best interest:

- Future-Proofing Your Organization: With systems increasing in complexity, a centralized flow design enables businesses to stay agile in future landscapes.

- Gaining Competitive Features Through AI Optimization: PMATGA CSFD’s aligns itself seamlessly with technologies like machine learning and predictive analytics that set brands apart.

- Boosting Scalability: Businesses that need to expand can leverage PMATGA CSFD’s to maintain stability amid growth.

Looking Ahead with PMATGA CSFD

While still in its developmental prime, PMATGA CSFD’s impact reflects an undeniable trend afflicting multiple sectors toward advanced optimization. Experts predict that by 2030, all scalable systems operating above regional levels will feature charters or direct dependencies rooted particularly within its adaptable frameworks.

Unravel Tomorrow, Today

Intrigued about PMATGA CSFD and how to implement it within your business? Stay tuned for future industry updates on how this next-gen solution may change the paradigms of organizational frameworks as we know them!

BUSINESS

Znxnz – Revolutionizing Digital Solutions for Businesses

The way we conduct business is changing rapidly, and those already ahead of the digital curve are reaping the rewards. Enter Znxnz, a trailblazer in the digital solutions space, delivering innovative tools and services to help businesses adapt, grow, and thrive. Whether you’re a startup aiming to establish a strong foundation or an enterprise looking to scale operations efficiently, Znxnz promises to be the digital ally you’ve been waiting for.

This blog will uncover how Znxnz is reshaping the business landscape, its game-changing solutions, and why it could be the key to your business success.

What is Znxnz?

Znxnz is more than just another tech company; it’s your partner in building smarter, more efficient, and innovative business strategies. Armed with a comprehensive suite of tools, Znxnz specializes in solutions tailored to the modern needs of businesses, combining cutting-edge technology with seamless user experiences.

From AI-powered process optimization to tailored product development, Znxnz’s core mission is to simplify complexities and empower businesses to focus on impactful growth.

Core Services Offered

- AI-Driven Analytics

Crafting strategies shouldn’t rely solely on guesswork. Znxnz equips businesses with analytical tools driven by artificial intelligence. These tools help process vast datasets in seconds and extract actionable insights to drive better decision-making.

- Custom Software Development

Znxnz doesn’t believe in one-size-fits-all. They create personalized software solutions—from enterprise resource planning to customer relationship management systems—that are tailored to meet specific business goals.

- Comprehensive Digital Marketing Solutions

Visibility in the digital space is key to staying competitive. With Znxnz’s performance-driven digital marketing team, businesses can attract the right audience through SEO, PPC, social media campaigns, and more.

- Cloud and IT Infrastructure Management

With a focus on resilience and scalability, Znxnz covers cloud solutions that ensure seamless integration and long-term reliability while optimizing operational costs.

- Automation and Workflow Optimization

Repetitive tasks? Znxnz has you covered! Their automation tools streamline workflows, reduce manual errors, and free up valuable labor for strategic roles.

Why Businesses are Choosing Znxnz

Innovative tech service providers are everywhere; so, what makes Znxnz a cut above the rest?

1. Custom-tailored Solutions

Unlike some platforms that offer ready-made tools requiring businesses to adjust their processes, Znxnz takes a personalized approach. This guarantees that every business receives relevant tech, making scalability and adaptation smoother.

2. User-centric Design

Complexity is the enemy of productivity. Znxnz prioritizes intuitive, user-friendly interfaces, ensuring that solutions work seamlessly across all teams.

3. Scalability at Its Core

Businesses evolve, and Znxnz ensures that their digital solutions grow alongside their users. Whether it’s adapting to new verticals, scaling operations, or integrating with existing infrastructures, Znxnz ensures seamless transitions.

4. ROI-Driven Results

Digital investments mean little without measurable results. Znxnz emphasizes clear metrics and ROI indicators to ensure its clients see value throughout the engagement.

5. Dedicated Support and Community

Up-and-running tech is only part of the equation. Znxnz provides comprehensive support post-deployment, ensuring any issues or optimizations are addressed swiftly. Bonus? Their community forum offers businesses a platform to exchange ideas, challenges, and solutions.

Real-World Applications of Znxnz

The versatility of Znxnz’s suite makes it a go-to for a wide array of industries. Below, we share how it’s helping businesses across critical sectors.

Retail

From inventory automation to AI-powered sales forecasting, Znxnz helps tackle unique retail challenges. Brands using Znxnz have reported a 35% reduction in stock-related errors and a 20% lift in overall productivity.

Healthcare

Znxnz’s workflow optimization tools are helping healthcare providers streamline patient management, reduce paperwork, and dedicate more hours to quality patient care.

Small Businesses & Startups

For smaller organizations looking for impactful solutions that don’t break the bank, Znxnz offers scalable, cost-efficient tools that are perfect for facilitating growth even on limited budgets.

Marketing Agencies

Optimize campaigns, and track in-depth KPIs with Znxnz’s bespoke digital marketing solutions. Their tools enable faster content iterations and effective targeting strategies.

How Znxnz is Shaping the Future of Digital Solutions

The pace of digital transformation accelerates every year, and businesses must adapt to stay competitive. But Znxnz isn’t content with simply following tech trends. They aim to set them.

- At the forefront of AI development

With evolving AI applications, Znxnz’s consistently pushes boundaries by integrating machine learning and predictive models into its software, making processes smarter and more forward-thinking.

- Sustainability Features

Znxnz’s is dedicated to aligning technology with sustainability goals. Their cloud platforms are designed with energy efficiency in mind, ensuring businesses reduce their digital carbon footprint.

- Focus on Collaborative Workflows

Remote and hybrid work is here to stay. Znxnz’s is adapting to this reality by offering solutions focused on secure, collaborative, and totally integrated workflows.

Taking the First Step with Znxnz

Whether you’re looking to fine-tune a specific aspect of your business, improve internal efficiencies, or take your operations to the next level, Znxnz’s is ready to support your goals. Their comprehensive services, backed by cutting-edge technology, mean worry-free scaling and sustainable long-term growth.

Want to learn more? It only takes a minute to get the ball rolling. Visit [Znxnz’s website link] and book a free consultation today.

-

BLOG9 months ago

BLOG9 months agoEscape to Tranquility Experience Grange Bardage Percheronne in Normandy

-

LIFESTYLE9 months ago

LIFESTYLE9 months agoAir Jordan 1 Retro High Off-White University Blue

-

SOCIAL MEDIA8 months ago

SOCIAL MEDIA8 months agoDecoding the Drive Social Media Pyramid Scheme Mystery

-

LIFESTYLE9 months ago

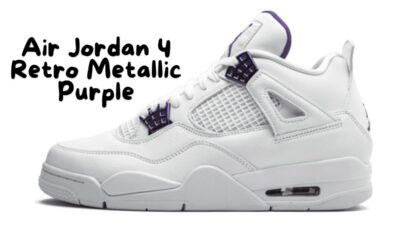

LIFESTYLE9 months agoAir Jordan 4 Retro Metallic Purple

-

BUSINESS8 months ago

BUSINESS8 months agoDemystifying 315-442-5267 Common Myths and Facts Revealed

-

LIFESTYLE9 months ago

LIFESTYLE9 months agoAir Force 1 Shadow Pistachio Frost

-

HOW-TO GUIDES8 months ago

HOW-TO GUIDES8 months agoShop Smart and Save with Goldengatemax.shop Online Guide

-

BLOG1 month ago

BLOG1 month agoDecoding 540-315-8592: From Numbers to Messages